Update date: July 17, 2021

On the one hand, today digitalization of medicine and healthcare is a very popular and rapidly developing topic, on the other, this market is a very complex and risky one. The vast majority of this market consists of government spending, including mainly various federal projects, as well as the expense of state and regional budgets. Back then, when various medical information systems and digital medical equipment were not yet widely penetrated into practical health care, this situation made sense. Today, without state investments in capital costs, including IT infrastructure and basic software, we would have still been waiting for the development of this industry.

However, lately, the situation has significantly changed. Basic computerization of healthcare is seen almost everywhere. Most doctors have computers connected to internal secure networks at least. Various medical information systems have been purchased and delivered; in many regions, detailed electronic health records have already been kept for several years. Almost every region has digital services for patients, at least one for making an appointment with a physician via the Internet and websites of medical organizations with reference information. The personal account of the patient, named "My Health" is being developed on the Unified Public Services Portal, designed to become a unified entry point to digital healthcare for citizens of the country.

In general, in Russia, there is quite fertile soil for creating a wide variety of software products in the field of digital health care. It seems to us that its time for the venture and private investments in this direction.

Forbes notes that “The Russian biotech is one of the most difficult industries for non-core and private investors. There is a high threshold for entry: you need to compete with the "big pharma", which has big money, and at the same time have fairly deep expertise" (https://www.forbes.ru/finansy-i-investicii/388605-kak-byvshiy-bankir-hochet-zarabotat-na-borbe-s-rakom-i-insultami-v).

Kommersant writes: “Projects of digital technologies in healthcare are the undisputed leader in the struggle for the attention of investors” and quotes Natalya Kuznetsova from O2Consulting: “These are various developments based on artificial intelligence for diagnosing diseases... and specialized software for organizing and managing clinical trials, including some using and processing Big Data" ( https://www.kommersant.ru/doc/3990032).

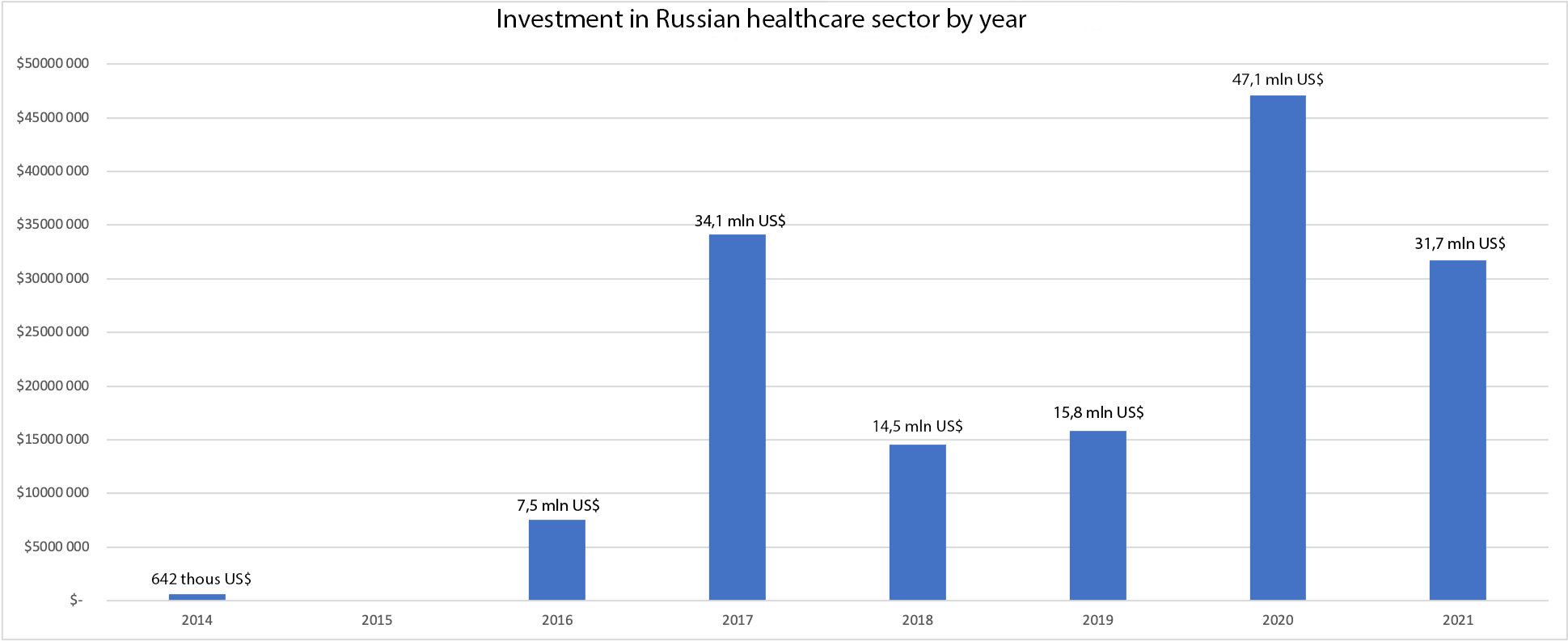

Despite the complexity and riskiness of the digital healthcare market, we see a certain activity of private investors. We have found information about investing in Russian digital health, starting in 2014, in open sources. The total data in US dollars is presented by the following graph:

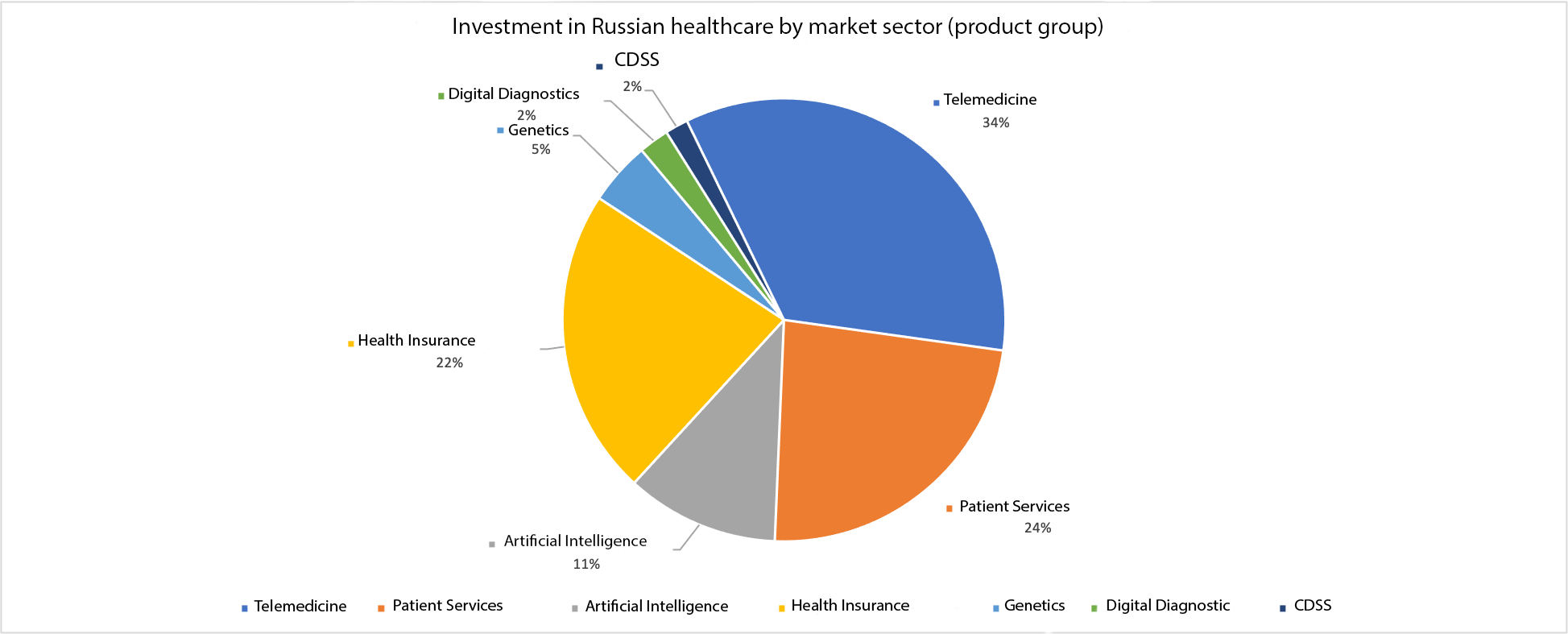

Investment amounts by market sector (product group) are presented in the diagram:

The list of publications about transactions is presented in the tables below.

2021

| № | Project | Sector | Trade value |

| 1 | Mo, the Russian service for meditation, sleep, and relaxation has attracted investments from the co-founder of Mail.ru Group Dmitry Grishin and a group of business angels. July 2021, Source >>> |

Patient Services | 1 mln US$ |

| 2 | MDinc, a start-up for the development of methods for the treatment of nervous diseases, attracted investments from Konstantin Klyuka, еру managing partner of the Kontinuum Group investment company June 2021, Source >>> |

Patient Service | 300 thousand US$ |

| 3 | BestDoctor attracted 4th round of investments from Winter Capital Partners and two funds from Europe June 2021, Source >>> |

Health Insurance | 26 mln US$ |

| 4 | Checkme MedTech-startup attracted investments to develop a mobile application April 2021, Source >>> |

Patient Services | 380 thousand US$ |

| 5 | Russian health tech startup Halsa has attracted investments on the United Investors platform. The company will use the funds received to increase production capacity and customer base. March 2021, Source >>> |

Patient Services | 200 thousand US$ |

| 6 | The Russian biohacking service Biodata has attracted investments from the founder of Skyeng, Georgy Soloviev. March 2021, Source >>> |

Patient Services | No data |

| 7 | Service for pregnant women AMMA Pregnancy Tracker attracted investments from SOSV international investment fund to enter the Asian markets March 2021, Source >>> |

Patient Services | 250 thousand US$ |

| 8 | The Winter Capital Partners Fund, of which Vladimir Potanin is a key investor, has acquired a 20% stake in DocClub, which develops an interactive platform of the same name for the professional development of doctors, simulating patient admission based on real medical histories March 2021, Source >>> |

CDSS | 600 thousand US$ |

| 9 | Medical startup OneCell (Vansel LLC), developing a platform for cancer diagnostics using artificial intelligence, attracted private investment March 2021,Source >>> |

AI | 3 mln US$ |

2020

| № | Project | Sector | Trade value |

| 1 | Qiwi co-founder Sergey Solonin invested in Zabota 2.0: a Russian medical tech startup developing a system for automating patient care, prevention, and medical marketing. Source >>> |

Other | The parameters of the deal were not disclosed |

| 2 | NTI Venture Fund invests in Celsus platform for medical diagnostics based on AI December 2020, Source >>> |

Artificial Intelligence | 180 mln rub. |

| 3 | Yandex invested in Genotek, which conducts research for private clients: research of the genetic history of the customer's ancestors, tendencies to certain diseases, product tolerance December 2020, Source >>> |

Genetics | 4 mln US$ |

| 4 | Igor Rybakov invested in AMMA Pregnancy Tracker. December 2020, Source >>> |

Patient Services | 200 thousand US$ |

| 5 | Botkin.AI platform designed to analyze and identify pathologies in computed tomography, X-ray, mammography images, attracted further investments for its development December 2020, Source >>> |

Artificial Intelligence | 160 mln rub. |

| 6 | Target Global and Palta, as well as S16 Angel Fund, have invested in Simple, a Russian startup that promotes an app to help you transition to a healthy and conscious diet through a gradual change in habits and nutritional discipline. The company's valuation reached 34.6 million euros. December 2020, Source >>> |

Patient Services | 4,1 mln € |

| 7 | The Swedish investment fund VNV Global, Mark Chang, and the Avenir investment holding have invested in the development of NaPopravku, an online appointment service in private and state clinics in Moscow and St. Petersburg September 2020, Source>>> |

Patient Services | 2,25 mln US $ |

| 8 | The Azbuka Vkusa food chain has invested in the Biolink.Tech startup, the developer of Otri, a food personalization system based on blood tests and artificial intelligence September 2020, Source >>> |

Patient Services | 337 thousand £ |

| 9 | AltaIR Capital, together with Runa Capital and other investors, invested in Undermyfork, which runs the app of the same name for people with diabetes August 2020, Source >> |

Patient services | 400 thousand US $ |

| 10 | A group of private investors invested in the development of the Webiomed project July 2020, Source >>> |

Artificial Intelligence | More than 130 mln rub. |

| 11 | International HealthTech-company Bioniq attracted investments from Medsi Group of Companies to develop a platform of the same name for integrated medical support July 2020, Source >>> |

Patient Services | 500 mln rub. |

| 12 | Venture funds AddVenture and Target Global, as well as LVL1, have closed the 3rd round of investments in the BestDoctor online corporate health insurance system July 2020, Source >>> |

Health Insurance | 4,5 mln US $ |

| 13 | Sergey Dashkov, Alexander Katalov, Maria Aksenova, and the Singapore Foundation Altergate have invested in the Checkme medical checkup service July 2020, Source >>> |

Patient Services | 375 thousand US $ |

| 14 | The Medsi group of companies acquired 12.5% of the authorized capital of Platforma Third Opinion LLC, which develops services for the analysis of medical information based on artificial intelligence June 2020, Source >>> |

Artificial Intelligence | The parameters of the deal were not disclosed |

| 15 | Mo, the Russian service for meditation, sleep, and relaxation attracted investments from AiTarget, as well as representatives of the United Investors syndicate of investors. May 2020, Source >>> |

Patient Services | 15 mln rub. |

| 16 | Former VKontakte product marketing manager Konstantin Ryabtsev, co-founder of Er-Telecom Holding Mikhail Vorobyov, and founder of the Biodata service Stanislav Skakun have invested in the Lifetime + service, which allows to sign up online for a test in one of the partner laboratories, receive test results and its preliminary decoding and further send the results to a physician May 2020, Source >>> |

Patient Services | 10 mln rub. |

| 17 | VEB.RF VEB Ventures structure invests in the development of clinic network and telemedicine platform Doctor Ryadom May 2020, Source >>> |

Telemedicine | 1 bln rub. |

| 18 | Pharmaceutical company "Cytomed" has invested in the development of the OnDoc service March 2020, Source >>> |

Patient Services | 1 mln US $ |

| 19 | Doc + has invested in the development of an AI service for medical records control February 2020, Source >>> |

Artificial Intelligence | 1 mln US $ |

| 20 | Merlion has invested in Zdorov Ya service, which provides patient routing services in medical institutions of Moscow and St. Petersburg. January 2020, Source >>> |

Patient Services | The volume of investments has not been disclosed, but according to Vademecum, it could have amounted to about 25 million rubles. |

2019

| № | Project | Sector | Trade Value |

| 1 | VEB Ventures are discussing investments in the Atlas Oncology Diagnostics project, which provides a diagnostic service for personalized oncology treatment. December 2019, Source >>> |

Digital Diagnostics | At the time of publication, the parties were discussing a deal in the amount of 50 million rubles. |

| 2 | The Innovation Assistance Fund issued a grant to EcoSoft LLC for the development of a CDSS for prescribing personalized dialysis and drug therapy to patients with chronic renal failure using AI algorithms December 2019, Source >>> |

CDSS | 20 mln rub. |

| 3 | The ExpoCapital Venture Fund of Igor Kim, the owner of Expobank, has acquired a minority stake in the Megapteka platform, which allows online drug bookings. November 2019, Source >>> |

Patient Services | Purchase of 7.28% in Platfomni LLC. The amount of the deal was not disclosed. One of Kommersant's sources estimated the value of the share at about $ 300 thousand. |

| 4 | RDIF has announced the completion of the first round of investments in the Assisted Surgical Technologies (AST) project, the developer of the first Russian robotic surgeon. The ideologist of the project is Dmitry Pushkar, chief urologist of the Ministry of Health, head of the Urology Clinic of the Moscow State Medical University. The company needs funds to obtain a patent, conduct clinical research and produce industrial designs. November 2019, Source >>> |

Robotics | The parameters of the deal were not disclosed |

| 5 | BestDoctor, a medical company that creates high-tech insurance products for businesses, has attracted investments to expand its business and enter the international market. The leading fund was Target Global, managed by Alexander Frolov and Mikhail Lobanov. The round was attended by AddVenture funds, Ascent, and a group of business angels as well. October 2019, Source >>> |

Health Insurance | 3 mln US $ |

| 6 | The European Medical Center (EMC) acquired 20% of Med-Status LLC, which manages the MedStatus product, which is positioned as a physician-oriented service for patient routing management. September 2019, Source >>> |

CDSS | The amount of the deal was not disclosed |

| 7 | Former Russian national team players Alexey and Vasily Berezutskiy acquired 25% of Telemed LLC each, another 25% was acquired by the owner of SFM Group Andrey Artamonov. The company develops services for remote medical consultations. Investments are planned to be directed to the development of new products and solutions for the telemedicine market. July 2019, Source >>> |

Telemedicine | The amount of the deal was not disclosed. The authorized capital of the company has increased from 10 thousand rubles to 33 million rubles. |

| 8 | RDIF has invested in Oncobox, a company that develops solutions in the field of cancer diagnostics. Oncobox is working on a platform that will allow molecular diagnostics of oncology at different stages. AI selects optimal drugs and effective treatment methods by instantly processing large volumes of patient data, May 2019, Source >>> |

Digital Diagnostics | 100 mln rub. |

| 9 | RDIF has invested in NeuroChat and Neurotrend companies, which develop innovative products and solutions based on neurotechnologies. NeuroChat has patented a multimodal brain-computer interface system that allows you to type text on a computer screen without using speech or movement. May 2019, Source >>> |

Artificial Intelligence | 300 mln rub. |

| 10 | RBV Capital funds (the fund's investors are the R-Pharm group of companies and RVK) and Digital Evolution Ventures (the management company Orbita Capital Partners), with the participation of Primer Capital and ExpoCapital funds, have invested in the Botkin.AI artificial intelligence platform in the field of healthcare, which is being developed by Intellogic. May 2019, Source >>> |

Artificial Intelligence | 100 mln rub. |

| 11 | AMMA Pregnancy Tracker service for pregnant women and their families has closed the seed round from angel investors from Russia, Hong Kong, Korea, as well as from the Prytek group 2019, Source >>> |

Patient Services | 1,6 mln US$ |

2018

| № | Project | Sector | Trade Value |

| 1 | Atlas Ventures, a Singapore-based foundation, has invested in Medical Information Solutions (MIR), the developer of The Doctor's Guide and My Health. Investments are directed to new developments, scaling of finished products, and sales development. December 2018, Source >>> |

CDSS | 65 mln rub. |

| 2 | Yandex, Baring Vostok, and the Swedish venture capital fund Vostok New Ventures hold the third round of investment in Doc + telemedicine service August 2018 Source >>> |

Telemedicine | 9 mln US$ |

| 3 | The Russian-Japanese Investment Fund (RJIF) and the Russian Direct Investment Fund (RDIF) have invested in the Doctis telemedicine service. The funds are planned to be used to create a "virtual clinic", introduce technological developments, and improve its mobile app. June 2018, Source >>> |

Telemedicine | 250 mln. rub. 70% of the company belongs to the founder of the service, Mark Kurtser, RJIF received 15%, RDIF 12.4%, the rest is from the Middle East funds |

| 4 | Stanislav Chernin, a private investor, has invested in the Celsus project. It is a system for detecting breast cancer based on AI technologies. The investments are aimed at creating infrastructure as well as the project team. 2018, Source >>> |

Artificial Intelligence | 20 mln rub. |

| 5 | IIDF invested in Qapsula, a service for free medical consultations in the messenger. The investment is aimed at developing functionality and marketing. February 2018, Source >>> |

Telemedicine | Purchase of 25% of the company for 15 million rubles. |

2017

| № | Project | Sector | Trade Value |

| 1 | The venture capital fund IP Fund, created with the participation of Rukard, has invested in service for the development of attention, memory, and thinking using Wikium game mechanics. 2017, Source >>> |

Patient Services | Purchase of 35.15% in LLC Wikium and 40% in LLC CRTKS Vikium for $ 2 million. |

| 2 | Pharmstandard invested in Genotek, a company working in the field of genetic data analysis 2017, Source >>> |

Genetics | 1 mln US$ |

| 3 | CEO of Rusagro Group Maxim Basov, Executive Partner and Founder of Bright Capital Boris Ryabov, Co-founder of Atlas Biomedical Holding Artem Rudi, 2GIS Shareholder and Investor in Dodo Pizza Dmitry Sysoev, EY Partner Vladimir Gidirim, Founder of Gaijin Entertainment Anton Yudintsev, Cabra.vc, and CB Invest have invested in Welltory, a mobile cardiography app that measures heart rate amplitude to monitor stress and energy levels. 2017, Source >>> |

Digital Diagnostics | 1 mln US $ |

| 4 | BestDoctor attracted investments from AddVenture fund and a group of private investors. The main product of BestDoctor is corporate medical care, in which the employer pays only for services that were actually provided to employees. October 2017, Source >>> |

Health Insurance | 500 thousand US $ |

| 5 | Yandex and Baring Vostok fund implemented the 2nd round of investments in the Doc + project. July 2017, Source >>> |

Patient Services | 5 mln US $ |

| 6 | Sberbank bought docdoc.ru, a service for scheduling doctor appointments online. May 2017, Source >>> |

Telemedicine | 79.6% of the company was acquired. The amount of the transaction was not disclosed, but according to media reports, Sberbank paid no more than 1 billion rubles for the package. |

2016

| № | Project | Sector | Trade Value |

| 1 | CEO of Rusagro agricultural holding, Maxim Basov and ex-head of the presidential administration of Russia, Alexander Voloshin, invested in Genotek, which works in the field of genetic data analysis 2016, Source >>> |

Genetics | 2 mln US $ |

| 2 | Doc + doctor home visit service, which attracted investments from Yandex and the Baring Vostok fund 2016, Source >>> |

Patient Services | 5,5 mln US $ |

| 3 | An unspecified business angel invested in the Sotsmedica project 2016, Source >>> |

CDSS | 2 mln rub. |

2014

| № | Project | Sector | Trade Value |

| 1 | Two business angels, Alexander Rabinovich and Igor Gurkovsky, have invested in the"Doctor's Guide" project 2014, Source >>> |

CDSS | 23 mln rub. |

| 2 | IIDF invested in the project of Konstantin and Vasily Khomanov, the "Doctor's Guide" mobile app 2014, Source >>> |